This digital era brought lots of good impact in our life not just ease in the way we live and get information but in our earning and financial lives.

We will be discussing an important topic that many of us would love to know more about. Cryptocurrency has come to change our life’s in positive ways and we need to embrace and learn in order to benefit from it.

Cryptocurrency stands as a beacon of potential for those looking to diversify their income streams. The question on many minds is not just “what is cryptocurrency?” but “how to earn money from cryptocurrency?”

Today we will e discussing 5 ways you can start earning income from crypto currency. Before that it’s crucial to understand that the crypto landscape is vast and varied, offering numerous avenues for profit.

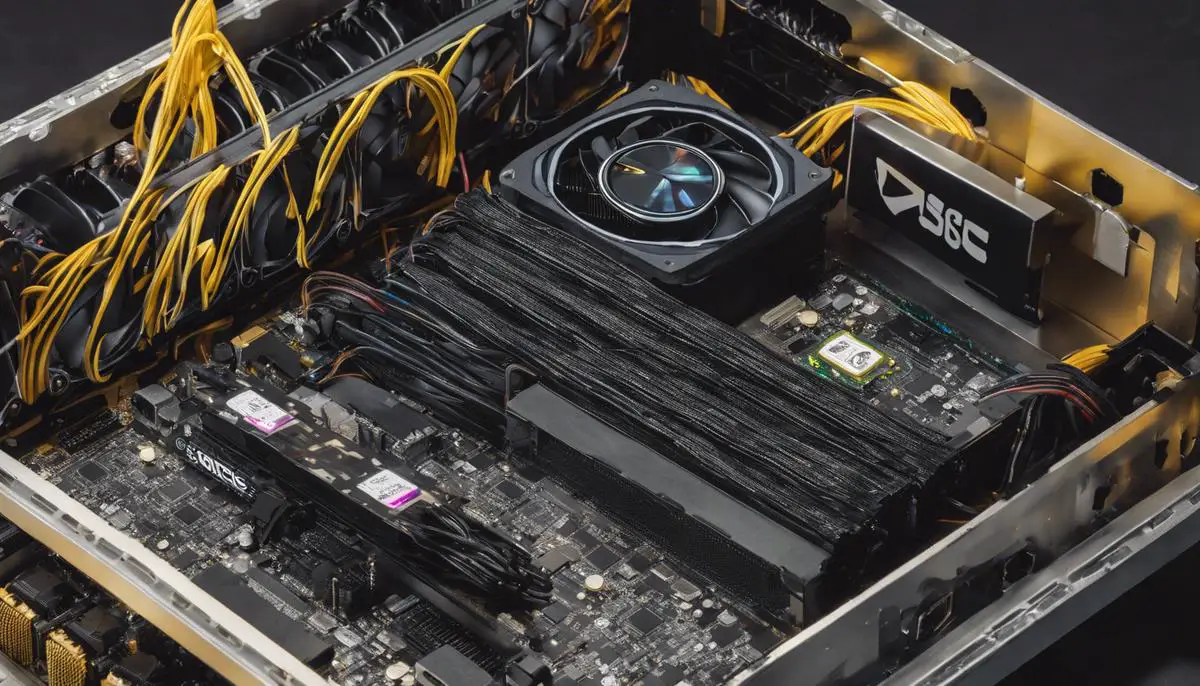

Crypto Mining has long been the bedrock of earning in the crypto domain. It’s the process of validating transactions and securing the blockchain, a task rewarded with newly minted coins. However, it requires significant technical knowledge and upfront investment in hardware.

Staking and Yield Farming represent the next frontier in crypto earnings. By holding and locking up certain cryptocurrencies, you can receive rewards. Yield farming takes this a step further, leveraging various DeFi platforms to maximize return on investment through lending or providing liquidity.

Trading and Investing in crypto can be likened to the high-stakes world of stock trading. It’s not for the faint-hearted but offers substantial rewards for those who can navigate the market’s volatility with skill and patience.

Crypto Lending and Borrowing platforms have emerged as a cornerstone of the decentralized finance (DeFi) movement. By lending your crypto, you can earn interest, while borrowing allows you to leverage your assets to engage in more significant trades or investments.

Lastly, Affiliate Programs and ICOs (Initial Coin Offerings) present a more indirect, yet potentially lucrative, method of earning. By promoting services or participating in new project launches, individuals can reap rewards in various forms of cryptocurrency.

As we explore these methods in detail, remember that the key to success in the crypto world is a blend of knowledge, caution, and a willingness to embrace new technologies. Stay tuned as we break down each method, ensuring you’re well-equipped to join the ranks of those profiting from the digital currency revolution.

1. Crypto Mining

Crypto mining is at the core of digital currencies. It secures the cryptocurrency network and processes transactions. Miners lend their computing power for these tasks and potentially earn cryptocurrency rewards.

Mining uses a consensus mechanism called Proof of Work (PoW). To verify transactions, miners solve complex mathematical puzzles. This prevents fraud by making it expensive to manipulate the network. When miners solve these puzzles, they add a new block of transactions to the blockchain and earn cryptocurrency.

Starting a mining operation requires specialized hardware like ASICs (Application-Specific Integrated Circuits) or advanced graphic cards. These machines solve the cryptographic puzzles but consume a hefty amount of electricity, so miners need to evaluate their energy costs.

Mining software connects the hardware to the blockchain and mining pool, if the miner chooses to join one. A mining pool is a group of miners who combine their computing power to increase their chances of solving puzzles and earning rewards, which are then distributed across the pool.

Miners must choose a cryptocurrency to mine. Not all cryptocurrencies use PoW, and some may not be worth the effort in terms of potential rewards and competition. It’s important to estimate potential earnings before diving in, taking into account factors like electricity cost and mining setup efficiency.

Mining combines the spirit of community and the allure of reward. It demands technical know-how and a willingness to tackle costs and competition. For those who venture into mining with understanding and preparation, it offers a window into the world of cryptocurrency as participants shaping its future.

2. Staking and Yield Farming

Staking and yield farming provide compelling ways to earn passive income in the cryptocurrency landscape. Instead of the computational power required for mining, these methods leverage existing crypto assets.

Staking is similar to earning interest in a savings account. In networks using the Proof of Stake (PoS) consensus mechanism, cryptocurrency owners lock up a portion of their holdings as a security deposit to validate transactions and create new blocks. In return, stakers receive rewards, usually additional tokens. This approach enhances network security and scalability while providing a passive income stream for token holders invested in the network’s success.

Yield farming, a cornerstone of Decentralized Finance (DeFi), amplifies the staking concept to maximize returns. Participants lend or stake their crypto assets in DeFi platforms to earn interest or rewards that often come in multiple token forms. It’s like putting money in high-yield investment opportunities, navigating lending pools, liquidity provision, and staking within DeFi protocols.

Yield farming’s allure lies in its potentially high returns compared to traditional banking interest rates. Algorithms automate the process of switching assets across DeFi platforms to chase the highest yields. It has quickly become one of DeFi’s most engaging activities, attracting both beginners and veterans.

However, staking and yield farming carry risks. Cryptocurrency’s volatility means yields can fluctuate greatly. The complexity and nascent nature of DeFi also bring risks like smart contract vulnerabilities, impermanent loss in liquidity pools, and regulatory uncertainties. Pursuing high rewards requires vigilance and informed risk-taking.

Staking and yield farming offer illuminating opportunities to earn passive income in the cryptocurrency realm. They represent the transition from merely holding assets to actively participating in and profiting from the dynamic DeFi ecosystem. With a foundation in blockchain principles and keen risk management, these strategies provide a glimpse into the future of finance.

3. Trading and Investing

Cryptocurrency trading and investing can be like navigating volatile seas. Different strategies, from day trading to long-term holding, require understanding the nuances of each approach.

Day trading involves buying and selling crypto within short time frames, often within a single day. It capitalizes on small price movements and requires vigilance and quick decision-making. While potentially rewarding, it also brings high risk due to volatility.

Swing trading spans days to weeks, holding positions open to capitalize on expected market swings. It demands adept analysis of market trends and patience to ride waves of market momentum. By avoiding the frenetic pace of day trading, swing traders aim to profit from broader cryptocurrency price movements.

Long-term holding, or ‘HODLing,’ involves investing in cryptocurrencies with the belief in their potential for exponential growth over years or decades. Long-term holders view market volatility as mere ripples on the path to eventual substantial returns. This strategy requires steadfast faith and resilience against short-term market fluctuations.

Regardless of the strategy, thorough market research is crucial. Understanding historical price trends, current market sentiments, and other factors is indispensable. Coupled with an informed risk management plan, including stop-loss orders and diversification, traders and investors are better equipped to navigate uncertainty and chart a course towards profitability.

Success in trading or investing in cryptocurrencies is far from guaranteed. It is a journey fraught with risk, requiring strategic wisdom, precise planning, and the grit to persevere through tumultuous times. For those who engage in discerning market research, understand volatility, and apply diligent risk management, the horizon holds promise for rewarding ventures in the vibrant cryptocurrency markets.

4. Crypto Lending and Borrowing

Crypto lending and borrowing offer an innovative solution for maximizing digital assets’ utility by either earning interest on holdings or using them as collateral for loans. This unique feature of the cryptocurrency ecosystem resonates with traditional financial practices, rejuvenated with a blockchain twist.

For lenders, depositing digital currencies into a lending platform transforms idle assets into active ones generating yields over time. By offering their coins as a loan, users receive interest payments according to predetermined rates and schedules. This method of accruing interest provides an attractive way to generate passive income, supplementing the dynamic yet uncertain nature of cryptocurrency investments with a steady stream of returns.

Borrowers find in crypto lending a versatile tool to access necessary funds without relinquishing their cryptocurrency holdings. Instead of selling their assets, they can pledge them as collateral and receive a loan in fiat currency or another crypto. This mechanism provides flexibility to meet immediate financial needs or pursue further investment opportunities while still holding onto assets for potential future appreciation. The blockchain acts as an immutable ledger, providing transparency, security, and efficiency to these financial transactions.

Platforms offering crypto lending and borrowing services have flourished, adding to the ecosystem’s diversity. These service providers bridge the gap between lenders seeking returns and borrowers needing capital, maintaining the equilibrium necessary for a vibrant marketplace. Options range from centralized exchanges that manage the lending process to decentralized finance (DeFi) platforms that allow participants to interact directly through smart contracts.

Navigating the crypto lending and borrowing landscape requires caution and due diligence. While the allure of earning passive income or accessing capital without selling assets is undeniable, risks are proportional to rewards. Interest rates can fluctuate, collateral value can change due to market volatility, and platform security can be compromised. Regulatory uncertainties also loom, reminding participants to proceed with informed prudence.

Crypto lending and borrowing encapsulate the transformative potential of merging traditional finance with blockchain technology. They open avenues for passive income, provide liquidity, and enhance capital efficiency while championing transparency and inclusivity principles. As users engage with these platforms, they contribute to the financial democratization heralded by digital currencies, all while navigating the symbiotic relationship between opportunity and risk within digital finance’s ever-evolving narrative.

5. Affiliate Programs and ICOs

Affiliate programs in the crypto realm offer enthusiasts a way to promote exchanges, wallets, and services in return for a share of the revenue. Like modern-day bards, affiliate marketers weave tales of financial sovereignty and security, enticing both seasoned traders and newbies to venture into cryptocurrency, while earning commissions for their efforts.

To embark on this journey, one aligns with a cryptocurrency platform offering an affiliate program, then promotes it using unique referral links. Each new trader brought in, each purchase or sign-up, turns into commissions that may either trickle or flood one’s treasury, depending on the success of the efforts.

However, the affiliate marketer must be wary of potential pitfalls—overstated claims, unclear payout structures, and platforms that may vanish. The quest for commission requires vigilance in an open field.

Initial Coin Offerings (ICOs) present another avenue, allowing individuals to be ground-floor participants in potentially revolutionary blockchain initiatives. ICOs offer high risk and high reward, with tales of staggering returns where digital coins once worth pennies soared to eye-watering valuations.

Yet, for each success story, there are tales of loss. The unbridled potential and regulatory adolescence of ICOs create a breeding ground for vaporware and grand schemes that may crumble under scrutiny. Investors must discern genuine opportunities from glitter-coated pitfalls, a task demanding diligence, attention to detail, and sometimes, a bit of good fortune.

Both affiliate marketing in the crypto space and investing in ICOs offer riveting pathways to potential prosperity. They are modern-day equivalents of trading on the Silk Road or investing in the ventures of Magellan—full of opportunity, adventure, and no small measure of risk. As digital wayfarers seek to make their mark, they carry the lanterns of caution and curiosity, lighting their journey through an ever-evolving domain that straddles innovation and uncertainty.

Conclusion

While the cryptocurrency ecosystem is vast and filled with opportunities, mining stands as a cornerstone, embodying both the spirit of innovation and the pursuit of reward. It represents not just a technical endeavor but a gateway for enthusiasts to actively participate in shaping the future of digital finance. Understanding and engaging with mining operations offer a unique perspective on the value and potential of cryptocurrencies.